Sometimes running a solo enterprise feels like juggling too many jobs. You’re the marketer, bookkeeper, and choice-maker abruptly. Managing your money shouldn’t add more stress. That’s why finding the right business checking account for sole proprietor matters more than most people realize.

You might be using your personal account for both business and personal spending, but things can get messy fast. The good news is, this guide will help you understand how to keep your business finances clean and professional. You’ll examine why isolating your money is important, a way to pick the proper bank, and why Baselane is a smart preference for unbiased commercial enterprise proprietors like you.

Table of Contents

ToggleHow a Business Checking Account Differs from a Personal Account

A non-public financial institution account is constructed for regular use—paying bills, purchasing, and coping with household costs. An enterprise account, though, keeps all business income and expenses separate from your personal life. This difference is crucial for tax reporting and long-term booms.

Whilst you’re a sole owner, the IRS nevertheless expects accurate commercial enterprise facts. The usage of a business account creates a paper path that proves what’s enterprise-associated and what’s not. It also enables you to music income, pay vendors, and control cash flow more effectively.

Benefits of a Business Checking Account for Sole Proprietor

Opening an enterprise checking account for a sole owner gives you monetary clarity. You can tune in to where your cash goes and how much your enterprise earns each month. That visibility is crucial while filing taxes or getting ready for economic reports.

It additionally boosts your professional reputation. When clients ship bills to a commercial enterprise account as opposed to a non-public one, it alerts credibility. You seem more set up and sincere, which allows you to cozy up to better partnerships and clients.

What to Look for When Choosing a Business Checking Account

Look for an account that costs low or no month-to-month prices. Some banks charge unnecessary maintenance costs that eat into your profits. Baselane, for example, gives no-fee debts that help you keep more of your cash.

Also, take a look at automation tools like rate monitoring, document generation, and virtual bills. These features save time and reduce bookkeeping mistakes. If the account integrates easily with your accounting software, that’s another big advantage.

Why Baselane Is Ideal for Sole Proprietors

Baselane was built with small business owners and landlords in mind. It combines business banking, accounting, and automation in one simple platform. You can open an account online without visiting a branch or submitting long paper forms.

Unlike traditional banks, Baselane helps you manage your business revenue, track expenses, and send payments directly from one dashboard. It simplifies what used to take multiple tools and hours each week.

Setting Up a Business Checking Account for Sole Proprietor

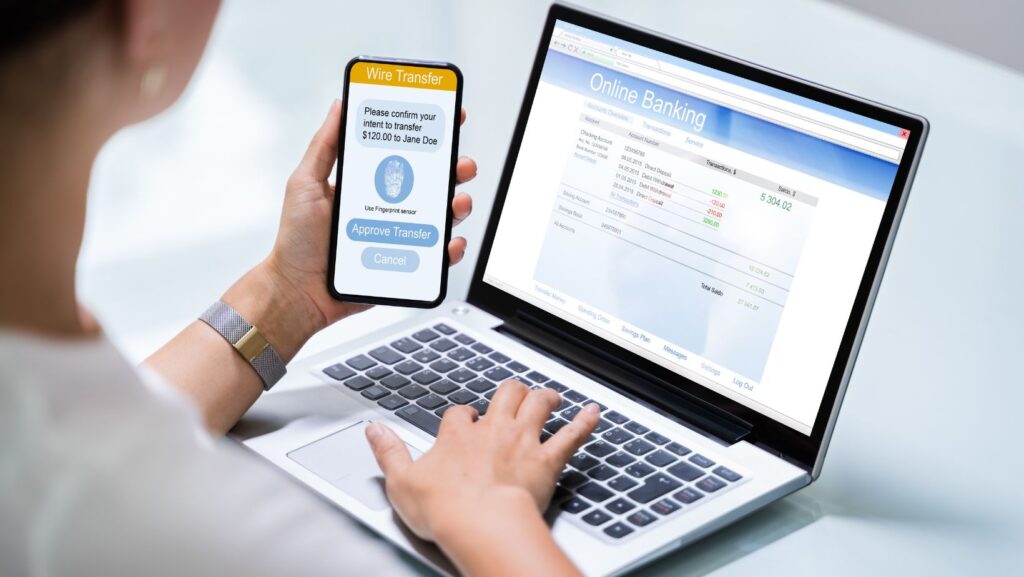

Opening your account is simple. You’ll need a few documents—your Social Security Number or EIN, business name, and address. Baselane’s technique is fully online, so you can set it up in minutes out of your computer or smartphone.

Once your account is open, join it on your business price tools or invoicing structures. Deposit your earnings immediately into your Baselane account and begin paying providers or tracking transactions routinely.

Managing Your Finances Efficiently

Whilst you separate business and personal budgets, you simplify the entirety. You’ll recognize exactly what’s deductible and what’s not when tax season arrives. With a dedicated account, your accountant or tax software can handle reports faster and with fewer mistakes.

You furthermore may get a higher photo of your cash going with the flow. Baselane gives actual-time transaction updates, so you always recognize how much you could spend or save. This transparency enables you to plan for charges and set apart money for taxes without last-minute panic.

How Baselane Simplifies Banking for Sole Proprietors

Baselane does more than hold your money. It offers you gear that makes commercial enterprise control smoother. You could categorize transactions mechanically, link earnings to precise residences or projects, and generate monetary summaries instantly. It’s also known as the best bank for sole proprietorship, giving you tools tailored for small business needs. It also helps with budgeting and forecasting. With the aid of reading spending patterns, Baselane helps you see in which you may cut expenses or reinvest earnings. The whole lot updates in real time, preserving your knowledge and assurance for your economic decisions.

Security and Compliance with Baselane

Security is a top concern for any business owner. Baselane protects your finances with FDIC coverage through its banking companions. Your statistics are encrypted, and transactions are monitored for suspicious pastimes.

It also guarantees compliance with financial rules. Whether its tax reporting or bank verification, Baselane keeps your records organized and ready for review if needed. That’s peace of mind for busy entrepreneurs.

Tax Advantages of a Separate Business Account

When your business and personal funds are separate, tax preparation becomes much easier. You can identify deductible expenses quickly and avoid mixing personal spending with business costs. This separation also provides clear documentation if the IRS ever reviews your finances. A dedicated business account with the best bank for sole proprietorship supports your expense claims and helps you avoid potential penalties. It’s a smart, proactive step that simplifies your tax life.

Comparing Baselane to Traditional Banks

Conventional banks regularly charge hidden fees, require in-character visits, and provide limited automation. Baselane removes those barriers. You could manipulate the whole thing online, from bills to reviews, without paying for additional features you don’t want.

Baselane additionally offers you faster right of entry to your budget and integrates with modern-day tools built for freelancers, landlords, and small enterprise proprietors. While traditional banks feel outdated, Baselane fits the way you actually work today.

When to Upgrade to a Business Savings Account

Once your checking balance grows, you would possibly want to move greater funds into a high-yield savings account. Baselane gives this feature, allowing you to earn an aggressive hobby whilst maintaining your available cash.

This step facilitates you maximizing returns on idle finances, together with tax reserves or emergency coins. It’s a smart way to make your money work harder without taking on risk.

Future of Business Banking for Sole Proprietors

The future of small commercial enterprise banking is virtual, speedy, and automated. Sole owners don’t need to waste time in branches or deal with previous structures. Structures like Baselane are the main ones that shift, presenting modern answers that adapt to your desires.

You’ll see greater banks integrating automation and AI-pushed insights and immediately get admission to capital. Baselane already provides that foundation, making it easier for you to grow without the traditional banking friction.

FAQs

Do sole proprietors need a business financial institution account?

Yes. It separates commercial enterprise and personal finances, simplifies taxes, and protects your expert popularity.

What files are required to open a Baselane account?

You need a Social Security Number or EIN, business name, and contact details.

How is Baselane different from traditional banks?

Baselane offers no-fee accounts, automation tools, and online setup, unlike traditional banks that rely on manual processes.

Can Baselane help with tax filing?

Yes. Its expense tracking and reporting tools make tax filing faster and more accurate.

Is Baselane secure for business banking?

Absolutely. Baselane uses FDIC-insured banking partners and encrypted data protection for full security.

Conclusion

Managing your finances as a sole proprietor doesn’t have to be complicated. The proper account keeps your commercial enterprise prepared, simplifies taxes, and protects your credibility. A dedicated business checking account for a sole proprietor is the first step toward better money management.

When you use Baselane, you get a platform designed for your reality—flexible, fast, and transparent. Start by opening your account, separating your funds, and using Baselane’s smart tools to streamline everything. You’ll save time, stay compliant, and make every financial move count.